Background: Wider recognition that climate risks affect business and financial performance of companies has resulted in the growing importance of climate disclosures for investors. In the US the Securities and Exchange Commission (SEC) has published rules and guidance about disclosing impacts of climate change on companies’ performance. Disclosures facilitate investors’ assessment of companies’ performance by ensuring consistent, comparable and reliable information about financial effects of climate risks on a company’s business and how the company manages such risk. Accordingly, companies, Mutual Funds (MF) and Exchange traded Funds (ETFs) are required to file disclosures on climate-related information to SEC.

hiddime

Friday, 26 July 2024

Thursday, 25 July 2024

ESG financial analysis – a role in future innovations

To recommence with ESG in financial analysis, we will focus on how ESG will play a role in future innovations in order to even be an important part within financial considerations.

With the current interest and range on all things of environment and clean energy, it is no surprise that the innovations and investments that are on the rise and have been consistently yielding good returns are all related to ESG in some form.

- Renewable energy: the transition to a low-carbon economy is driving investment in renewable energy sources, such as soap and wind power, According to the international Energy Agency (IEA), renewable energy is the only source of energy that is growing globally.

- Electric vehicles: the growth of electric vehicles is another area that is attracting significant investment as companies seek to develop new technologies that support the transition to electric mobility. According to BloombergNEF, the market for electric vehicles is expected to grow rapidly in the coming years.

- Sustainable agriculture: investment in sustainable agriculture is on the rise, as companies seek to develop new technologies and techniques to reduce waste and increase yields while minimizing the environmental impact of agriculture, this includes precision farming techniques alternative protein sources, and new business models that prioritize sustainability.

- Green bonds: Green bonds are a type of bond that is issued to finance projects with a positive environmental impact, such as renewable energy or sustainable infrastructure. Investment in green bonds has been growing rapidly in recent years, with investors seeking to support sustainable projects while also earning a return on their investment.

Finally, the companies that prioritize sustainability and ESG factors are yielding strong results for several reasons.

- Improved risk management: companies that prioritize sustainability and ESG factors tend to have better risk management practices, by identifying and managing ESG risks, companies are better able to avoid costly lawsuits, regulatory fines, and damages to reputation.

- Cost savings: suitability initiatives can often result in cost savings for companies. For example, by reducing energy consumption, companies can lower their energy bills, while implementing waste reduction measures that can reduce the cost of waste disposal.

- Increased revenue: companies that prioritize sustainability and ESG factors are also more likely to attract customers who are concerned about sustainability issues which can result in increased revenue and market share for the company.

- Long-term value: sustainability and ESG factors are important indicators of long-term value for companies. By prioritizing sustainability, companies are better able to position themselves for long-term success and create value for shareholders over the long-term.

In conclusion, companies that prioritize sustainability and ESG factors are more likely to be well-managed, attract customers and investors, and create long-term value for shareholders. As a result, these companies are yielding strong results in terms of financial performance and overall sustainability.

Tuesday, 23 July 2024

NLP a Powerful Tool for ESG INVESTING

Environmental, Social, and Governance (ESG) factors are now widely recognized as important drivers of long-term financial performance, and investors are increasingly seeking to integrate ESG considerations into their decision-making process.

To that end, Natural Language Processing (NLP) has emerged as a powerful tool for analyzing ESG data and providing valuable insights to investors. NLP is a subfield of artificial intelligence that deals with the interactions between computers and human languages, and it can be applied to various text data related to ESG, such as news articles, social media posts, financial reports, and other sources.

Here are some ways in which NLP can be used to analyze ESG data and inform sustainable investing decisions:

Sentiment Analysis:

NLP can be used to analyze the sentiment of ESG-related news articles and social media posts to understand public opinion on ESG issues. By tracking sentiment over time, investors can identify potential risks and opportunities associated with certain ESG factors, and adjust their investment strategies accordingly.

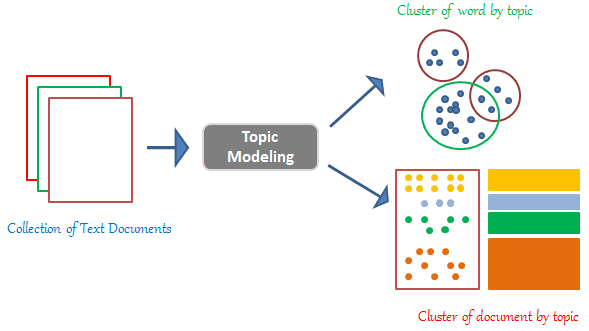

Topic Modeling:

NLP can be used to identify and categorize ESG-related topics in large volumes of text data. This can help investors understand which ESG issues are most relevant and how they are interconnected. For instance, topic modeling can reveal that climate change and renewable energy are closely linked, and that they have significant implications for companies operating in the energy sector.

Entity Recognition:

NLP can be used to identify and categorize specific entities mentioned in ESG-related text data, such as companies, people, or locations. By tracking the ESG performance of specific entities over time, investors can assess their ESG risks and opportunities, and make informed investment decisions.

Event Detection:

NLP can be used to identify significant events related to ESG, such as environmental disasters, corporate scandals, or regulatory changes. By monitoring ESG events in real-time, investors can adjust their investment strategies to mitigate potential risks and seize opportunities.

Text Classification:

NLP can be used to classify ESG-related text data into categories such as environmental impact, social responsibility, or corporate governance. This can help investors understand which ESG factors are most important to them and make investment decisions accordingly.

Overall, NLP is a powerful tool that can help investors make more informed decisions about sustainable investing by analyzing large volumes of ESG-related text data and providing valuable insights into ESG sentiment, topics, entities, events, and classifications. As ESG investing continues to grow in importance, NLP is likely to play an increasingly important role in shaping the future of sustainable investing.

Wednesday, 17 July 2024

ESG reporting framework

Environmental, social, and governance (ESG) reporting has become an essential aspect of corporate transparency and accountability. The ESG framework provides a comprehensive set of metrics that businesses can use to evaluate and report on their environmental, social, and governance impact to customers, employees, and investors.

The ESG reporting framework includes three main categories: environmental, social, and governance. Let’s take a closer look at each of these categories:

- Environmental: This category includes metrics related to a company’s impact on the environment. These metrics may include greenhouse gas emissions, energy consumption, water usage, waste management, and other environmental factors.

- Social: This category includes metrics related to a company’s impact on society. These metrics may include labor practices, human rights, diversity and inclusion, community engagement, and other social factors.

- Governance: This category includes metrics related to a company’s management and governance practices. These metrics may include board composition, executive compensation, ethics and compliance, risk management, and other governance factors.

The ESG reporting framework provides a standardized set of metrics for companies to report on their environmental, social, and governance impact. The framework is designed to help companies identify areas where they can improve their sustainability and responsible business practices. By using this framework, companies can benchmark their ESG performance against industry peers and best practices.

There are several reporting frameworks available for ESG reporting, including the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD). Each of these frameworks provides guidance on specific ESG metrics and reporting requirements.

In conclusion, the ESG reporting framework provides a standardized set of metrics for companies to report on their environmental, social, and governance impact. ESG reporting is an essential aspect of corporate transparency and accountability, and it can help companies demonstrate their commitment to sustainability and responsible business practices to stakeholders. By using this framework, companies can benchmark their ESG performance against industry peers and best practices, and attract socially responsible investors who prioritize sustainability and responsible business practices.

Monday, 15 July 2024

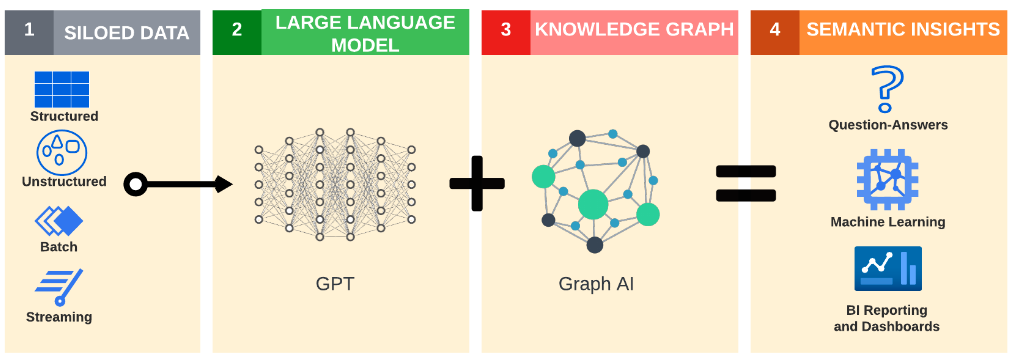

Rise of the NEW AI Stack (GraphRAG – LLM, RAG, Knowledge Graph)

LLM Hallucinations, Lack of Domain Specificity: LLMs (Generative AI) understand natural language questions or requests as input and produce answers in natural language. However, LLMs are prone to producing incorrect answers due to ‘hallucinations’. And, LLMs suffer from the lack of focused domain specificity in the answers they generate.

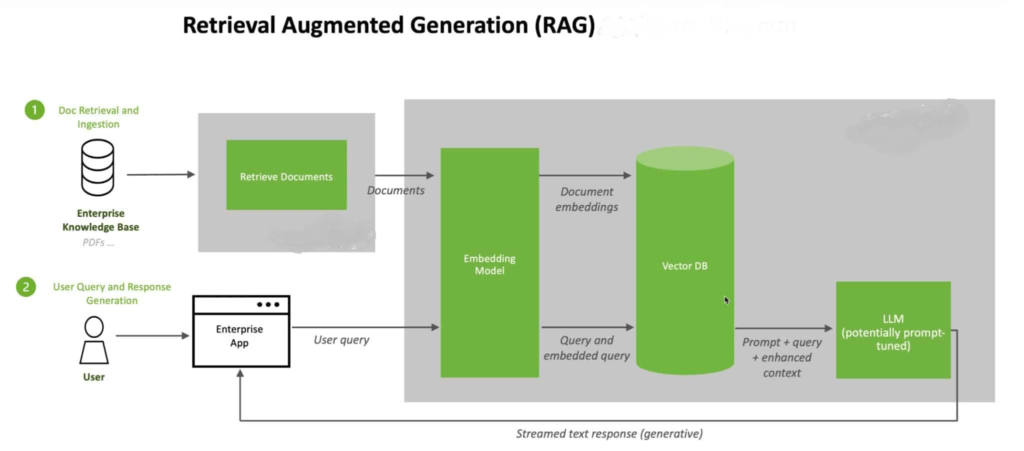

A new technique ‘Retrieval Augmented Generation’ or RAG on top of LLMs has been the go to solution to solve the issues and get improved answers from LLMs.

Semantic Matching & Contextualization: RAG utilizes a database of the embedding vectors of the text within documents from the domain of interest. The user query is transformed into an ‘embedding vector’ and semantically matched against the Vector DB of document vectors. Text corresponding to the matched vectors is collated into the context of the LLM prompt along with the user query. The LLM, now restricted to the context within which to find answers to the user query, is reined in to produce relevant answers.

RAG with LLM technique reduces hallucinations and produces better domain specificity in the answers. RAG is now the popular, practical, and de facto technique for developers and for AI vendors to use in their solutions.

While effective for many use cases, RAG has critical weaknesses, which include inability to leverage the connections that exist among the entities in the text and its inability to handle summaries well. Relations among real world entities that are reflected in the text, are critical to understanding the text. This lack of handling relations points to a critical gap that needs to be fixed.

Enter Knowledge Graphs

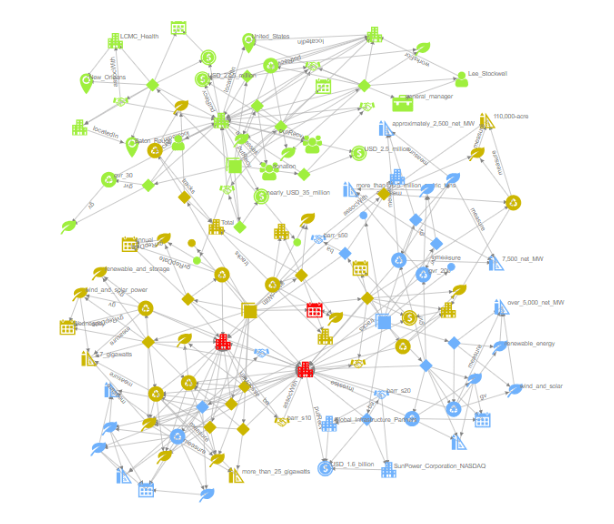

The connections between different entities extracted from the text form the knowledge with a structure of a graph or the knowledge graph.

A new AI stack that incorporates Knowledge graph of entities and their connections on top, fixes the critical gaps in RAG + LLM solutions. Our AI language understanding software, TextDistil, is built on this new AI stack that we are advocating.

Microsoft Research recently alluded to this new technique of overlaying Knowledge Graphs on RAG solutions in their recent article. The new technique is touted as GraphRAG.

TextDistil, GraphRAG on steroids: At Lead Semantics, we developed a ‘Knowledge Graph extraction from Text’ product, TextDistil back in 2020 (discussed in paper). TextDistil was upgraded to LLM+RAG over the course of last year and stands as one of the first production solutions that is built natively using GraphRAG. TextDistil extracts the Knowledge Graph from the RAG store on the fly and populates an RDF triple store. TextDistil answers user questions in natural language against a corpus of documents with accurate and precise answers compared to plain RAG + LLM solution.

Send us an email or contact us to checkout GraphRAG solution for your production needs.